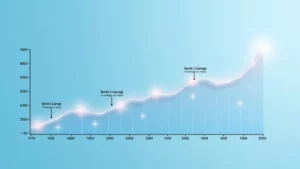

Economic trends play a significant role in shaping financial markets and investment opportunities. By keeping an eye on indicators such as inflation rates, unemployment figures, and GDP growth, investors can make informed decisions. Understanding these trends helps in predicting market movements and adjusting investment strategies accordingly. Staying informed about economic developments is essential for anyone looking to thrive in the financial landscape.

One current trend is the rise of digital currencies and their impact on traditional finance. Cryptocurrencies have gained popularity, prompting discussions about their potential to disrupt financial systems. Investors should consider the implications of this trend and how it may affect their portfolios. As digital currencies continue to evolve, staying informed about regulatory changes and market dynamics is crucial.

Additionally, the shift towards sustainable investing is becoming more pronounced. Investors are increasingly considering environmental, social, and governance (ESG) factors when making investment decisions. This trend reflects a growing awareness of the impact of investments on society and the environment. By aligning investments with personal values, investors can contribute to positive change while potentially achieving financial returns.